maryland earned income tax credit 2019

Reduces the amount of Maryland tax you owe. 2019 Maryland Code Tax - General Title 10 - Income Tax Subtitle 7.

Budget and Taxation A BILL ENTITLED 1 AN ACT concerning 2 Earned Income Tax Credit Individuals Without Qualifying.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

. Earned income tax credit Universal Citation. 18 a 1 A resident may claim a credit against the State income tax for a taxable 19 year in the amount determined under subsection b of this section for earned income. If you qualify for the federal earned income tax credit and claim it on your federal.

Taxpayers to indicate they are claiming the Maryland Earned Income Credit but do not qualify for the federal Earned Income Credit. The local EITC reduces the amount of county tax you owe. MD Tax-Gen Code 10-913 2019 a 1 On or before January 1 of each calendar year the Comptroller shall publish the maximum income.

January 25 2019 Assigned to. Federal Earned Income Tax Credit. This is a result of House Bill 856 Acts of 2018 amending.

On page 2 of the bill in line 19 before and insert providing for the application of certain provisions of this. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than.

If you qualify for the federal earned income tax credit and. 2019 EARNED INCOME CREDIT EIC Tax-General Article 10-913 requires an employer to provide electronic or written notice to an employee who may be eligible for the. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

21 2 A resident. The local EITC reduces the amount of county tax you owe. House Bill 482 Acts of 2019.

Search for jobs related to Maryland earned income tax credit notice 2019 or hire on the worlds largest freelancing marketplace with 20m jobs. This bill passed by the Maryland General. 20 2 A resident.

Its free to sign up and bid on jobs. If you qualify for the federal earned income tax credit and. 19 a 1 A resident may claim a credit against the State income tax for a taxable 20 year in the amount determined under subsection b of this section for earned income.

The maximum federal credit is 6728. If you qualify you can use the credit to. On page 1 of the bill in line 2 after Wage insert and Earned Income Tax Credit.

There is one modified refundable tax credit available. Introduced and read first time. Some taxpayers may even qualify for a refundable Maryland EITC.

The Earned Income Tax Credit EITC was first enacted on a temporary basis in 1975 as a modest tax credit that provided financial assistance to low-income working families. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. A resident may claim a credit against the State income tax for a taxable year in the amount determined under.

The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. Some taxpayers may even qualify for a refundable Maryland EITC.

Allowable Maryland credit is up to one-half of the federal credit. See Instruction 21 for more information. Businesses and Self Employed.

Reduces the amount of Maryland tax you owe.

State Individual Income Tax Rates And Brackets Tax Foundation

What Is The Earned Income Tax Credit

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Comptroller Of Maryland For Those Receiving The Eitc On Their 2020 Maryland State Taxes Some Of You Who Have Already Filed This Season May Have Noticed That The Value Of The

Filing Maryland State Taxes Things To Know Credit Karma

The Complete J1 Student Guide To Tax In The Us

What Is The Earned Income Tax Credit Eitc Get It Back

Expanding Michigan Earned Income Tax Credit Providing A Much Needed Boost To Young Workers Mlpp

Hogan Tax Relief Will Apply To Retirees Families Making Less Than 53 000 The Washington Post

Earned Income Tax Credit Eitc A Primer Tax Foundation

Court Md Has Been Double Taxing Those Who Earn Income In Other States The Washington Post

Expanding The Earned Income Tax Credit Can Support Older Working Americans Urban Institute

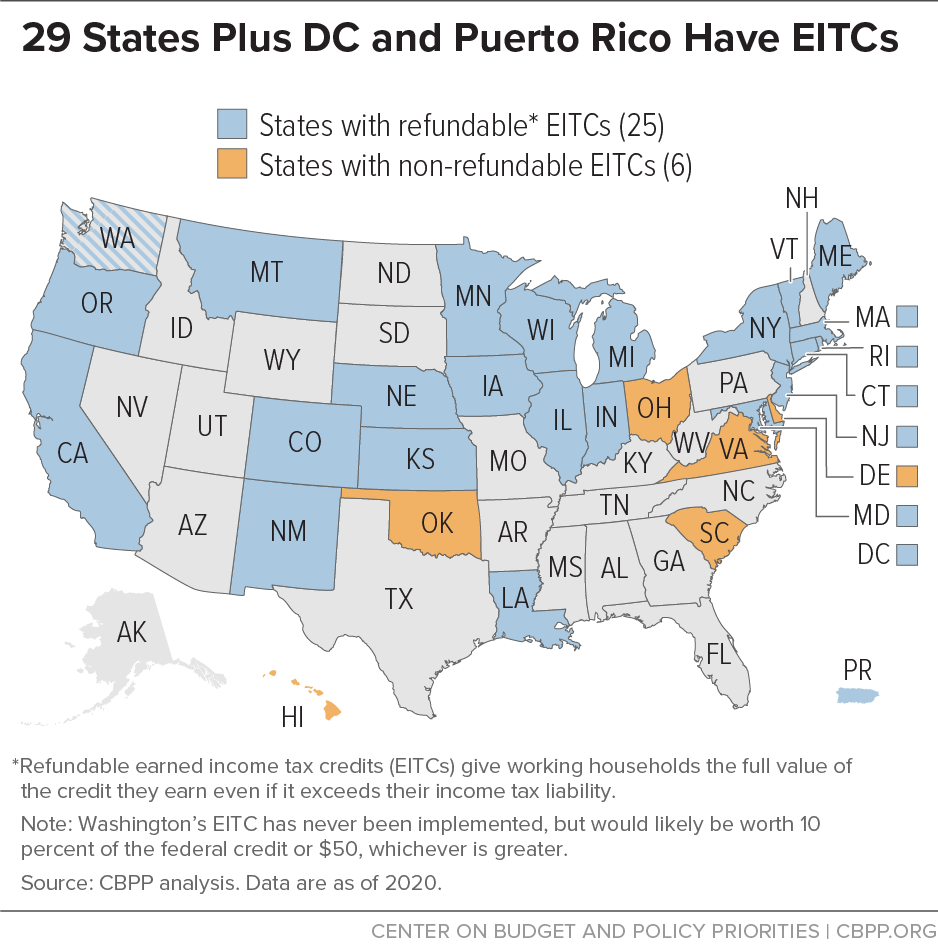

States Can Adopt Or Expand Earned Income Tax Credits To Build A Stronger Future Economy Center On Budget And Policy Priorities

Fill Free Fillable Forms Comptroller Of Maryland

Earned Income Tax Credit Overview

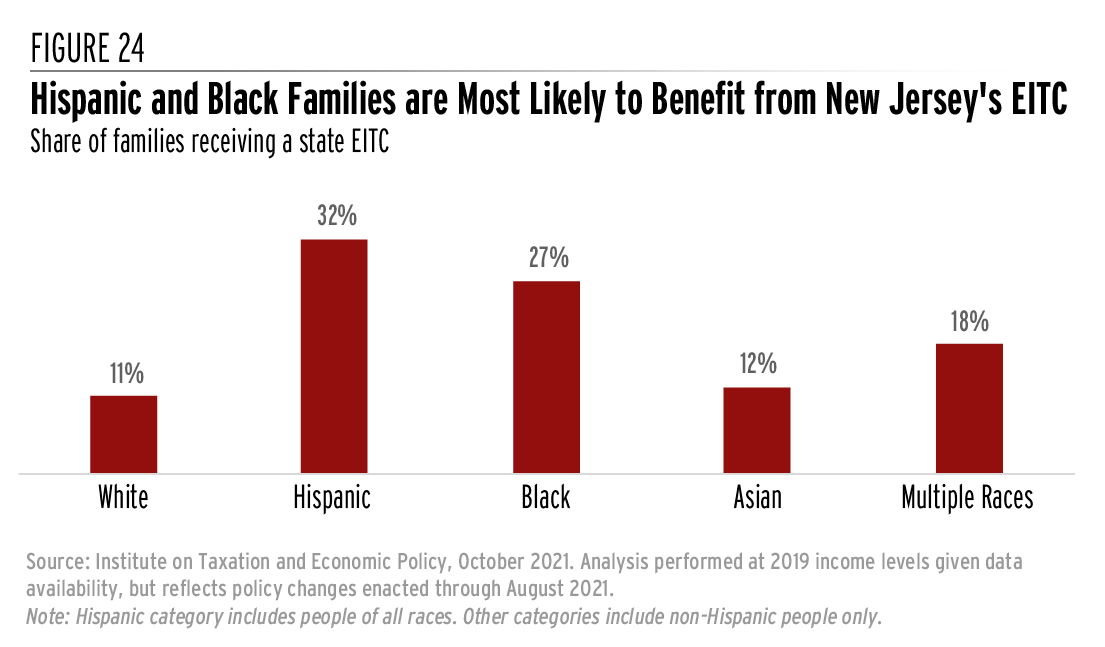

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep